Exit Planning: Segment A

![]() business exit planning

business exit planning

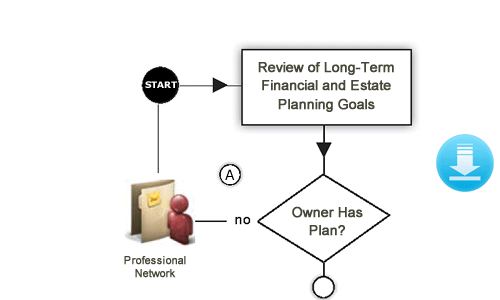

The Process Flow

- Start the exit planning process

- Review with owner their estate planning and financial goals

- Determine if they have a plan. If no, then refer them to our advisory network of estate planners.

| CFOne Advisory 1.571.306.3590 (DC) 1.804.527.1103 (Richmond) or e-mail your questions to: |

![]() business exit planning

business exit planning

Why Do Owners Exit

Our experience over the past 15 years note the following reasons why owners exit.

- Ready to Retire

This is a noble reason to exit. But it turns out to be an error for many owners. We often find that many retirees are looking to exit without any financial objective.

We recommend that owners plan their "retirement" exit with an long-term financial objective and age limit working together to maximize the benefit. - Burn-Out Factor

We experience those who exit simply do so due to burn out. They often are looking to explore "other opportunities".

This is a dangerous exit position to be in. Owners generally don't have the energy to maximize the the exit value. The financials begin to slip that devalue the company. - Health Reasons

This is an unfortunate position to be and often unexpected and unavoidable. Depending on the health position, the owner may need to exit promptly and health reasons generally impact the company value. - Need to Focus On a 2nd or 3rd Operation

Some business owners operate more than one business and will off-load one of the businesses that may not be performing. These owners are looking to get whatever value the market will bear.

Having an exit plan in place would have likely put them in a better position when offloading.

There are other reasons why owners exit. But these four reasons make-up about 90%+ of all exits.

So the first question in the exit plan is what are the benefits that the owner could realistically achieve. The goal is to come up with a realistic financial number that will meet your financial and estate planning objectives.

Helpful Tools

Some helpful forms business owners:

|