Exit Planning: Segment E

![]() business exit planning

business exit planning

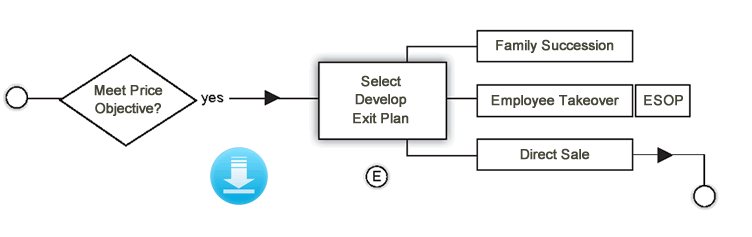

The Process Flow

- The valuation meets the price objective of the owner

- Select the exit plan that will be pursued once the exit date has been determined

- Selection includes a) family succession; b) ESOP; or C) direct sale

| CFOne Advisory 1.571.306.3590 (DC) 1.804.527.1103 (Richmond) or e-mail your questions to: |

![]() business exit planning

business exit planning

Succession Plans

The type of succession plan usually falls with these three key successions.

Family Succession

This will require a comprehensive valuation under estate planning rules. We cannot provide legal guidance, but we can help in the transfer over to family members under a fee arrangement.

Family succession may include direct family or extending family. Again, this is under legal guidance by one of the recommended advisors.

Employee Take Over

This will likewise require a comprehensive valuation to write-up the true valuation of the company when generating the legal documents.

Employee take-over can be in the form of a direct sale or employee stock ownership plan. Again, this is under legal guidance by one of our recommended advisors.

Direct Sale

The direct sale is the most selected plan among business owners. This is where our expertise comes in. We can facilitate the entire process to ensure the maximum price. Our fee is based only on the successful closing of the sale.

Helpful Tools

Some helpful forms business owners:

|